In the time it takes to read this sentence, a major supermarket chain like Profi processes dozens of transactions across the country, a high-velocity operation where even a momentary network failure can trigger significant revenue loss and customer frustration. For large-scale retailers, the reliability of payment systems has transcended mere convenience, becoming a cornerstone of operational stability and brand trust. The strategic partnership between the payment orchestration provider Symphopay and retail giant Profi has therefore emerged as a landmark case study, establishing a new benchmark for transactional resilience in the Romanian market. This collaboration highlights a critical shift in retail strategy, where ensuring every single payment is processed without fail is no longer an aspiration but a fundamental business imperative.

The New Imperative in Retail: Why Uninterrupted Payments Are Non-Negotiable

The modern retail environment operates on razor-thin margins and intense competition, where the customer experience at checkout is a final, decisive touchpoint. A failed transaction due to a network glitch can erode customer loyalty and directly impact the bottom line. Consequently, the concept of “uninterrupted payments” has evolved from a technical feature into a core strategic goal for any retailer aiming for sustainable growth and market leadership. The ability to guarantee seamless transactions, regardless of external factors like internet connectivity, is now a key differentiator.

This imperative is precisely what drove the collaboration between Symphopay and Profi. Their partnership serves as a powerful demonstration of how sophisticated payment orchestration can build a fortress of operational resilience around a retailer’s most critical revenue-generating process. By engineering a system that anticipates and neutralizes points of failure before they can disrupt business, Symphopay is enabling retailers to focus on growth and customer service, secure in the knowledge that their payment infrastructure is infallible. This initiative redefines what is possible for large-scale retail operations in Romania and beyond.

The Context: Profi’s Quest for a Flawless Payment Infrastructure

As one of Romania’s largest supermarket networks, Profi operates a sprawling footprint of 1,750 stores, each a hub of constant commercial activity. The sheer volume of daily transactions presented an immense operational challenge, where any systemic weakness could have cascading negative effects. Profi’s leadership identified several core vulnerabilities in their existing payment infrastructure that needed to be addressed to support their continued expansion and commitment to a superior customer experience.

The primary concern was ensuring absolute transaction continuity. Intermittent internet connectivity, a common issue in various locations, posed a direct threat to sales, potentially bringing checkout lines to a standstill. Furthermore, the high volume of payments required a system that was not only fast and reliable but also intelligent enough to manage complex backend processes. The task of reconciling transaction data from multiple partner banks was a labor-intensive and error-prone process, creating significant administrative overhead. Profi needed a unified, automated solution that could eliminate these risks and inefficiencies entirely.

Symphopay’s Technological Breakthrough

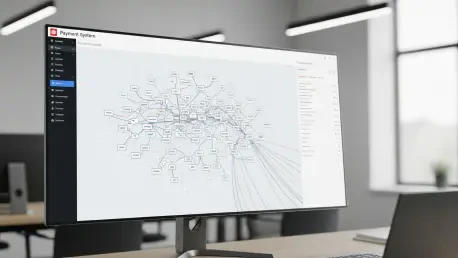

In response to Profi’s complex requirements, Symphopay developed and deployed a sophisticated payment orchestration solution engineered for maximum resilience and efficiency. Rather than merely upgrading existing components, the company designed a completely new infrastructure from the ground up, integrating intelligent failover mechanisms and automation at every level. This technological leap forward was not just a theoretical improvement but a practical system proven to handle immense pressure, such as processing a network-wide peak of over 30 transactions per second without a single point of failure.

The solution’s architecture was built on principles of redundancy and smart routing, moving beyond simple payment processing to true infrastructure management. By giving Profi a centralized platform to oversee and control its entire payment ecosystem, Symphopay delivered a system that was both robust and agile. Concrete capabilities, like instantaneous network switching and automated multi-bank reconciliation, transformed Profi’s checkout process from a potential vulnerability into a competitive advantage.

Dual Connectivity for 100% Uptime

At the heart of Symphopay’s solution is a dual-connectivity system embedded in every point-of-sale (POS) terminal. Each device is equipped with both a primary Ethernet connection and a secondary GSM (mobile network) connection, creating two independent pathways for transaction data. The payment application running on the terminal is designed to continuously monitor network health in real time, actively checking the stability and performance of the primary connection.

Should this monitoring detect any disruption or degradation in the Ethernet link, the system’s failover protocol is triggered automatically. In an instant, the transaction is rerouted through the GSM connection without any manual intervention required from the store staff. This switch is so fast and seamless that it is completely imperceptible to both the cashier and the customer at the checkout counter. The payment is processed securely, and the transaction is settled once full connectivity is restored, guaranteeing that no sale is ever lost due to a local internet outage.

Intelligent Transaction Rerouting

Beyond safeguarding against network failures, Symphopay’s platform introduces another layer of intelligence with its dynamic transaction rerouting capability. The system is integrated with Profi’s multiple acquiring banks, and it doesn’t just blindly send a transaction to a default processor. Instead, it makes a millisecond decision to route the payment to the most optimal acquirer based on real-time performance metrics. This ensures that the transaction is sent to the bank processor that is most likely to approve it quickly.

This intelligent routing delivers two significant benefits for the merchant. First, it maximizes transaction approval rates, reducing the chance of a “transaction declined” message caused by a temporary issue at a specific bank. Second, it allows the retailer to optimize processing costs by prioritizing acquirers with more favorable rates. As Symphopay’s co-founder, Sebastian Ioniță, explained, this fallback mechanism empowers retailers with unprecedented control over infrastructure risks, ensuring operational continuity without placing any additional burden on their in-store teams.

Automated Reconciliation and Multi-Bank Integration

One of the most significant back-office challenges for a retailer of Profi’s scale was the reconciliation of payments across its various banking partners. This traditionally manual process was time-consuming, complex, and susceptible to human error, draining valuable administrative resources. Symphopay’s platform directly addresses this pain point by automating the entire reconciliation workflow.

The solution seamlessly integrates with all of Profi’s partner banks, creating a single, unified source of transaction data. The platform automatically aggregates, sorts, and matches payment information from every store and every acquirer, generating consolidated reports that simplify financial oversight. This automation has dramatically increased back-office efficiency, freeing up the finance team to focus on more strategic activities and providing leadership with a clear, real-time view of the company’s revenue streams.

A Rapid, Large-Scale Deployment

The technical sophistication of the solution was matched by the remarkable efficiency of its implementation. Overhauling the payment infrastructure across 1,750 stores is a monumental task that would typically be expected to span many months and involve carefully planned store closures or downtime. However, the entire deployment for Profi was completed in an astonishingly short timeframe of just six weeks.

What makes this achievement particularly noteworthy is that the entire transition was executed without any disruption to Profi’s daily operations. The rollout was meticulously planned and carried out by specialized teams working outside of business hours to ensure that not a single store experienced downtime. This rapid and seamless deployment underscores Symphopay’s operational excellence and its deep understanding of the retail environment, where maintaining business continuity is paramount.

The Current Landscape: A Proven Solution Driving Market Confidence

The success of the Profi implementation has firmly established Symphopay as a leading force in the Romanian payment solutions market. The project served as a powerful proof of concept, demonstrating the platform’s ability to perform flawlessly under the extreme demands of a top-tier national retailer. This success has generated significant market confidence and has been instrumental in Symphopay’s expansion into other key sectors.

The versatility and robustness of the solution are evident in its widespread adoption by other major industry players. Its client roster now includes e-commerce giant eMAG, leading courier services like FAN Courier and Sameday, major shopping center owners such as NEPI Rockcastle, and other prominent retailers like Annabella and Intersport. This diverse portfolio showcases the platform’s adaptability, proving its value across different business models, from online retail and logistics to physical shopping environments.

Reflection and Broader Impacts

The successful overhaul of Profi’s payment infrastructure carries implications that extend far beyond a single company. It serves as a compelling case study for the entire retail industry, illustrating how strategic investments in resilient payment technology can yield substantial returns in operational stability, efficiency, and customer satisfaction. The project effectively rewrites the industry’s standards for what is possible in payment system reliability.

This collaboration has not only solved a critical business challenge for Profi but has also created a new paradigm for how large-scale retailers approach their technological infrastructure. The precedent set by this implementation is already influencing decision-making across the sector, prompting other major players to re-evaluate their own systems and consider the strategic advantages of a fully orchestrated payment ecosystem.

Reflection

Analyzing the key strengths of the Symphopay solution reveals a trifecta of benefits. First is its unparalleled resilience, built upon a foundation of dual connectivity and intelligent routing that virtually eliminates downtime. Second is the transfer of control over infrastructure risks from external variables to the merchant itself, empowering businesses to manage their own operational destiny. Finally, the platform delivers profound operational simplification for in-store staff and back-office teams, automating complex processes and allowing employees to focus on their core responsibilities.

The primary challenge in such an endeavor was undoubtedly the execution of a massive technological rollout without causing any interruption to business. Overcoming this hurdle required not just advanced technology but also meticulous project management and a deep understanding of the retail world’s unforgiving operational tempo. The successful outcome is a testament to the synergy between a visionary client and a capable technology partner.

Broader Impact

The Profi-Symphopay collaboration is actively shaping a new industry standard for payment system reliability and performance in Romania. It has demonstrated that 100% payment uptime is not a theoretical goal but an achievable reality, even for a network of thousands of stores with immense transaction volumes. This project provides a proven model for other large-scale retailers who are seeking to achieve complete payment continuity.

The future implications are clear: retailers will increasingly be expected to provide a flawless payment experience as a baseline offering. The success of this project moves the goalposts for the entire industry, pushing competitors to adopt similar levels of technological sophistication to remain competitive. It signals a market-wide shift toward payment orchestration platforms as the definitive solution for ensuring business continuity and fostering growth in the modern retail landscape.

Conclusion: Redefining Reliability in Retail Payments

The partnership between Symphopay and Profi had successfully redefined what reliability means in the context of retail payments. Through a combination of innovative technology and flawless execution, the project had achieved its ambitious goal of 100% payment uptime, enabling Profi to confidently handle peak traffic volumes without fear of disruption. The implementation provided a powerful testament to how a well-designed payment orchestration platform could transform a critical business function from a source of risk into a pillar of strength. This collaboration was not just a technological upgrade; it was a strategic move that fortified Profi’s operational foundation for future growth and set a new standard for the entire retail sector.