We’re joined today by Zainab Hussain, an e-commerce strategist with deep expertise in customer engagement and operations management. We’re exploring the seismic shift in how consumers discover and choose brands, moving from traditional search engines to direct conversations with AI shopping assistants. This interview will delve into the critical new landscape of AI-driven commerce, examining the risks of being invisible in this new arena, the metrics brands must now track to measure their standing, and the strategic importance of focusing on purchase-intent intelligence. We’ll also discuss why objective, transparent data is non-negotiable and what practical steps brands can take to improve their recommendations by AI.

We’re seeing shoppers ask AI assistants “where to buy furniture” instead of using traditional search. What specific risks do brands face by being invisible in these conversations, and what is the first step they should take to understand their current position?

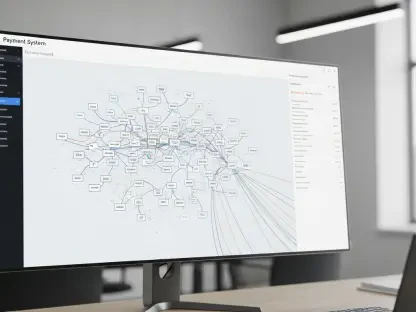

The most immediate and significant risk is simply becoming irrelevant. When a consumer bypasses a search engine and asks an AI for the “best gift for coffee lovers,” that is a high-intent moment to make a sale. If your brand isn’t mentioned in that AI-generated response, you’ve lost a potential customer you never even knew was looking. You’re completely invisible at the most critical point of the decision-making process, while your competitors are being directly recommended and capturing that sale. The first step for any brand is to get a baseline—you can’t fix a problem you can’t see. They need to use a public benchmarking tool to get an objective look at where they currently stand. It’s no longer enough to guess; you need to know if you’re even in the game.

The new AI Visibility Index uses a Visibility Score, LLM Ranking, and a Brand Trust Score. Can you break down how these three metrics work together to give a brand a complete picture of its standing, perhaps using an example from the apparel or electronics industry?

These three metrics provide a wonderfully holistic view that you can’t get from a single number. Imagine you’re a sportswear brand. Your Visibility Score, on a scale of 0 to 100, tells you how often you even appear when AI answers questions. A high score means you’re in the conversation. But that’s only part of the story. The LLM Ranking, from 1 to 10, tells you where you appear in that list of recommendations. It’s one thing to be mentioned; it’s another to be the first or second suggestion. Finally, the Brand Trust Score, from -100 to +100, measures the sentiment. Does the AI describe your products positively or negatively? So, your sportswear brand could have a 90% Visibility Score, but an LLM Ranking of 8 and a negative Brand Trust Score. This tells you that while you’re being mentioned, it’s as an afterthought and in a poor light. Together, these scores give a complete diagnostic of your brand’s health in the AI ecosystem.

Many tools track general brand mentions online. How does focusing specifically on “purchase-intent” prompts provide more actionable intelligence for retailers, and what kind of specific presence gaps does this approach typically uncover for a brand that thought it had good visibility?

Focusing on purchase-intent prompts is the difference between hearing background noise and listening to a direct sales inquiry. General brand mention tools are great for PR, but they don’t tell you if you’re closing a deal. Knowing your brand was mentioned in a blog post is not the same as knowing if an AI recommended you when a shopper asked, “best shoes for trail running.” This laser focus on purchase intent provides intelligence that is directly tied to revenue. A brand might have fantastic social media engagement and think their visibility is strong. However, this approach often uncovers shocking gaps. For instance, they might discover they are never recommended for specific, high-margin product categories, even though their overall brand is well-known. It reveals a disconnect between general brand awareness and actual consideration at the moment of purchase.

The Index has been compared to “the Nielsen ratings for AI Commerce,” emphasizing its observational nature. Why is it so critical for brands to have this kind of objective, uninfluenced data, and how does publishing the prompt libraries support that goal of transparency?

Objectivity is everything. In a new and evolving space like AI commerce, you can’t build a sound strategy on biased or manipulated data. Brands need a true north—an unvarnished look at what AI assistants are actually telling consumers. This observational, “Nielsen ratings” approach provides that. It’s not about paying for placement or trying to game the system; it’s about reflecting reality so brands can make genuinely informed decisions. Publishing the prompt libraries is a brilliant move for transparency because it demystifies the process. Brands don’t have to wonder how their score was generated. They can see the exact purchase-intent questions being asked, which builds trust and gives them the context they need to understand their performance and, more importantly, how to improve it.

Once a brand reviews its ranking in the free Index and discovers it’s lagging behind competitors, what are a few concrete strategies they can implement to improve how AI assistants perceive and recommend their products? Please walk us through the practical steps.

The first step after seeing a low rank on the public Index is to dig deeper. A high-level score tells you that you have a problem, but not why. The immediate next move should be to get a more comprehensive, granular analysis. This will identify visibility gaps at the specific product category level. For example, you might discover your furniture brand ranks well for “sofas” but is completely invisible for “dining tables.” Once you have that specific intelligence, you can begin crafting a targeted strategy. This involves ensuring your product information, descriptions, reviews, and related content for those weak categories are clear, authoritative, and easily accessible across the web. You are essentially curating the public information that these AI models learn from, making sure that when they look for the best “dining tables,” your brand’s excellent offerings are the most compelling and logical answer.

What is your forecast for the evolution of AI-driven commerce over the next two to three years?

Over the next two to three years, I believe AI-driven commerce will transition from a niche channel to a fundamental pillar of e-commerce strategy, just as crucial as SEO became two decades ago. We’ll see brands move beyond simple monitoring and establish dedicated teams focused on actively managing and optimizing their presence within AI recommendations. The expectation for transparency will grow, and objective, public-facing tools will become the industry standard for measuring success. This isn’t a fleeting trend; it’s the new battleground where market share will be won or lost. The brands that embrace this and build their strategies around it now will be the dominant players of tomorrow.