As direct-to-consumer (DTC) models reshape industries, the outdoor goods sector finds itself at a pivotal moment. We sat down with Zainab Hussain, a leading e-commerce strategist with deep expertise in customer engagement and operations, to dissect the challenges and opportunities facing outdoor brands. Our conversation explores the harsh economics of traditional retail, the critical need for a digital-first infrastructure, and how brands can strategically balance DTC ambitions with legacy retail partnerships to not just survive, but thrive in a rapidly evolving market.

You describe the initial challenge for manufacturers as getting into retail, where representation and distribution cuts significantly decrease margins. Can you walk us through the specific economics of this and provide a real-world example of how profits are eroded before a product even hits the shelf?

Absolutely. The uncomfortable truth for many emerging brands is that the battle is won long before the customer sees the product, but often at a cost that makes the victory feel hollow. Imagine you’ve poured years into developing a revolutionary new product. The first hurdle is just getting a meeting. Then come the layers of middlemen—representation, distribution, and marketing—and each takes a significant cut. Before you’ve even shipped a single unit, your margin is already shrinking. You’re giving up percentage points for shelf space, for logistics, for someone else to market your own creation. It’s a classic squeeze play where the system is specifically designed to extract value from the manufacturer, leaving them with the slimmest of profits while they carry all the risk.

Once a brand secures shelf space, they often face margin pressure and the risk of having their innovations replicated by private labels. Could you describe this dynamic in more detail and explain the leverage retailers use to enforce terms that strain a manufacturer’s cash flow and inventory?

It’s a brutal cycle. You finally get that coveted placement, and the pressure immediately intensifies. The retailer, holding all the leverage, pressures you on margin from day one. That innovative lure design you spent years perfecting? Within months, you might see a nearly identical white-labeled version sitting right next to it on the shelf, sold at a lower price. Worse, you are carrying all the inventory risk while the retailer pays on terms that can stretch for months, creating a massive cash flow problem. And if your product doesn’t sell within their specific, often arbitrary, window? You’re faced with the grim choice of either buying it back or accepting a markdown that completely erases any potential profit you hoped to make. It’s a power dynamic that leaves brands feeling trapped.

The traditional retail model is often described as antiquated and retailer-first. How does this model fail to deliver the choice and convenience modern consumers expect, and what are the first steps for a brand to begin building a direct relationship with its customers online?

The power center has fundamentally shifted away from the retailer and toward the consumer, but the old model hasn’t caught up. Consumers today demand endless choice, seamless convenience, and price transparency—three things traditional retail consistently fails to deliver at scale. Think about the local “mom-and-pop” tackle shops; they can no longer afford to stock diverse, emerging brands. They’re forced to carry only the top 1% of category winners, which stifles innovation and limits consumer choice. For a brand to break free, the first step is to recognize that its future lies in owning the customer relationship. This begins by building a digital foundation—a place where you control the narrative, own the customer data, and can actually grow your margins. It’s not just about a website; it’s about creating a direct channel to the people who truly love your products.

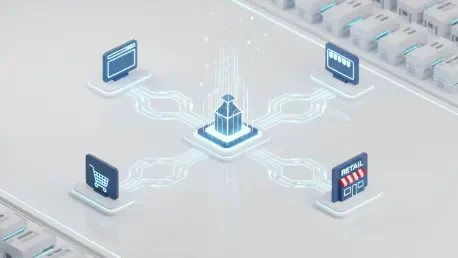

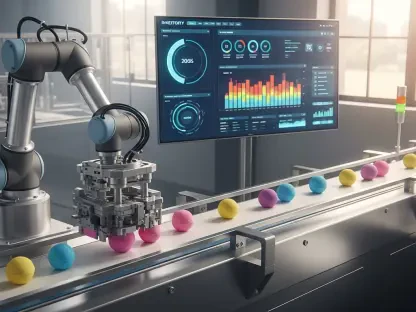

For manufacturers still using systems built for a retail-centric world, what are the most critical first steps to building a “digital-first” infrastructure? Could you break down what it means to centralize product information and invest in quality digital assets for multi-channel selling?

The biggest challenge is that most manufacturers are operating on systems designed for an analog era. Their product data is scattered across spreadsheets, their digital presence is an afterthought, and their processes are optimized for filling out retailer data templates, not for engaging customers. The first, most critical step is to build an infrastructure that gives you options. This starts with centralizing all your product information into a single source of truth. From there, you must invest in high-quality digital assets—great photography, compelling videos, detailed descriptions. This isn’t just for your own website; these assets are crucial for selling effectively everywhere your customers are, whether that’s on specialized marketplaces, through e-retailers, or even in traditional stores. It’s about creating a cohesive brand experience, no matter the channel.

Evolving brands are adding direct-to-consumer channels without abandoning traditional retail. How should a manufacturer evaluate when a retail partnership makes economic sense, and what key metrics should they use to ensure they maintain control over their brand positioning and margins in that partnership?

It’s not an all-or-nothing proposition. The smartest brands are becoming channel-agnostic, and they’re using DTC not as a replacement for retail, but as a powerful, profitable addition. The key is to reorient your priorities so that digital is the foundation, not the add-on. A retail partnership should be treated as just another channel, and it only makes sense if the economics are right and you maintain control. You need to rigorously evaluate the true cost of that shelf space. Look at the required margin, the payment terms, the inventory risk, and the potential for brand dilution. If a partnership forces you to compromise your positioning or accept razor-thin margins, it’s not a partnership—it’s a liability. The goal is to ensure every channel, including retail, serves the brand’s long-term health, not just a retailer’s short-term sales goals.

What is your forecast for the fishing tackle retail landscape over the next five to ten years?

The writing is on the wall, and it’s digital. The old operating system has collapsed. While physical retail won’t disappear entirely, its role will be fundamentally different. It will exist downstream of a brand’s digital infrastructure, not as the central pillar. Long-range projections from the global payments industry are stark, suggesting over 90% of commerce will happen online by 2040. The brands that build their entire strategy around chasing retail shelf space are building on a foundation that is actively crumbling beneath them. The successful manufacturers of the next decade will be those who embrace a digital-first mindset today. They will be the ones who own their customer data, control their brand narrative across all channels, and have the agility to meet consumers wherever they choose to shop. The shift is inevitable; the only question is who will lead it and who will be left behind.