In the fast-paced world of independent restaurants, where margins are tight and employee satisfaction can make or break a business, the challenge of managing tip payouts efficiently has long been a pain point. Imagine a server finishing a grueling shift, only to wait days or even weeks to access hard-earned tips due to manual processes or cash flow constraints. This delay not only frustrates staff but also impacts retention in an industry already grappling with high turnover. Enter the innovative collaboration between SpotOn, a leading restaurant management system, and Visa Direct, a global digital payment network, designed to tackle this very issue with instantaneous tip distribution and streamlined operations.

This review dives deep into the technology behind SpotOn’s integration with Visa Direct, specifically through the DayCheck solution. It examines how this partnership addresses critical financial and operational hurdles for independent restaurants across eligible US states. By leveraging cutting-edge payment infrastructure, this integration promises to transform the way tips are handled, benefiting both employees and owners. The following sections explore the standout features, technological underpinnings, real-world impact, and future potential of this solution in reshaping the restaurant industry’s financial landscape.

Core Features of SpotOn’s DayCheck with Visa Direct

Instant Tip Payouts for Employees

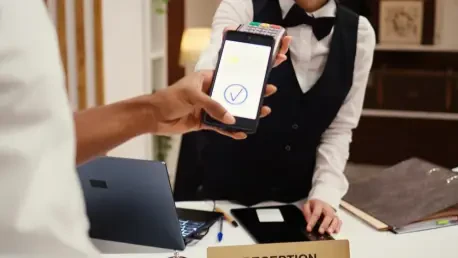

One of the most compelling aspects of this integration is the ability to provide restaurant staff with immediate access to their tips. Through Visa Direct’s robust payment network, servers and other tipped employees can receive their earnings directly into their accounts at the end of a shift, bypassing the traditional delays associated with cash distribution or payroll cycles. This rapid payout system empowers workers with greater control over their finances, allowing them to address personal expenses without the stress of waiting.

Beyond convenience, this feature significantly boosts employee satisfaction. In an industry where financial stability is often a concern for hourly workers, the ability to access earnings instantly can foster loyalty and reduce turnover. Restaurant staff no longer need to rely on loans or credit to bridge gaps between pay periods, creating a more supportive work environment that prioritizes their well-being.

Streamlined Operations for Restaurant Owners

For restaurant owners, the DayCheck solution offers a remarkable reduction in administrative workload. The system automates tip calculations, eliminating the need for manual tracking or reconciliation, which often consumes valuable time and resources. By integrating with Visa Direct, it also removes the hassle of handling large amounts of cash, minimizing risks such as theft or errors during distribution.

Another standout benefit is the lack of a prefunding requirement for eligible merchants. Unlike some payment solutions that demand upfront cash reserves to cover payouts, this integration supports healthier cash flow by allowing businesses to settle tips without straining their immediate finances. This operational efficiency enables owners to focus on enhancing customer experiences and growing their establishments rather than getting bogged down by backend financial tasks.

Technological Foundation and Industry Alignment

The seamless functionality of SpotOn’s DayCheck with Visa Direct rests on Astra’s enterprise-grade payments infrastructure. This technology ensures that transactions are not only swift but also secure, handling everything from initiation to settlement with precision. Astra’s automated treasury functions further simplify the process by reducing manual intervention, making the system reliable even during high-volume shifts at busy restaurants.

This collaboration aligns perfectly with broader industry trends leaning toward digital-first payment solutions. As independent restaurants face mounting pressure to optimize operations amid economic challenges, the demand for efficient, tech-driven tools continues to grow. The integration reflects a shift in focus toward employee-centric innovations, where financial transparency and speed are becoming key differentiators in attracting and retaining talent.

Moreover, the partnership taps into a growing preference for contactless and instantaneous transactions among both businesses and consumers. By adopting such forward-thinking technology, SpotOn and Visa Direct position themselves at the forefront of a movement that prioritizes agility and adaptability in an ever-evolving hospitality sector. This alignment with market needs underscores the relevance of their solution in today’s competitive landscape.

Real-World Benefits for Independent Restaurants

Across eligible US states, independent restaurants adopting this integration have reported tangible improvements in their day-to-day operations. For instance, smaller establishments that once struggled with manual tip distribution now experience smoother workflows, freeing up managers to focus on customer service rather than paperwork. This operational ease translates into a more polished dining experience, indirectly boosting patron satisfaction.

The impact on employee retention cannot be overstated. By offering instant tip payouts, restaurants using DayCheck position themselves as preferred employers in a sector notorious for high staff turnover. Workers are more likely to stay with businesses that demonstrate a commitment to their financial well-being, creating a virtuous cycle of stability and loyalty within the workforce.

Additionally, the technology offers a competitive edge in markets where labor shortages remain a persistent challenge. Restaurants equipped with modern payment solutions can attract top talent by showcasing a progressive approach to compensation, setting themselves apart from competitors still reliant on outdated methods. This real-world advantage highlights the transformative potential of the integration for the broader industry.

Challenges and Opportunities for Growth

Despite its many strengths, the SpotOn Visa Direct integration faces certain limitations that could hinder widespread adoption. Availability remains restricted to specific regions, leaving some independent restaurants unable to access the technology due to geographic constraints. This uneven rollout poses a barrier for businesses eager to modernize but located outside eligible areas.

Another hurdle lies in the learning curve for smaller establishments unfamiliar with digital payment systems. Transitioning from traditional cash-based processes to a tech-driven platform may require training and support, which could deter some owners hesitant to embrace change. Addressing this gap through accessible resources and onboarding assistance will be crucial for broader acceptance.

Efforts are reportedly underway to expand coverage and enhance merchant support. By prioritizing outreach to underserved areas and offering tailored guidance for less tech-savvy operators, the partnership can overcome these challenges. Such initiatives will likely play a pivotal role in ensuring that the benefits of instant payouts and streamlined operations reach a wider audience in the coming years.

Future Potential of Payment Solutions in Hospitality

Looking ahead, the SpotOn Visa Direct integration holds immense promise for further expansion and refinement. Plans to extend availability to additional regions over the next few years, from 2025 onward, could significantly broaden its impact, bringing modern payment solutions to more independent restaurants struggling with outdated systems. This growth trajectory suggests a future where digital tip payouts become the industry standard.

Beyond geographic reach, there is potential for adding new features to enhance the employee experience. Tools such as integrated financial planning apps or savings options tied to tip payouts could provide workers with even greater control over their earnings. These enhancements would reinforce the technology’s role as a holistic solution for workforce financial health.

For merchants, future updates might include expanded eligibility criteria or integrations with other operational tools, further simplifying restaurant management. As the hospitality sector continues to embrace digitization, this collaboration is poised to lead the charge in redefining financial ecosystems, ensuring that both owners and employees benefit from cutting-edge innovations tailored to their unique needs.

Final Thoughts and Next Steps

Reflecting on this review, the collaboration between SpotOn and Visa Direct through the DayCheck solution proves to be a transformative force in the restaurant industry. It tackles longstanding issues of delayed tip payouts and administrative burdens with impressive efficiency, delivering measurable benefits to employees and owners alike. The technology stands out for its ability to enhance financial transparency while aligning with digital trends shaping the sector.

Moving forward, stakeholders should focus on accelerating regional expansion to ensure equitable access for all independent restaurants. Providing robust training programs for merchants new to digital payments would also help bridge adoption gaps, maximizing the solution’s reach. Additionally, exploring complementary features like employee financial tools could elevate the platform’s value proposition, cementing its place as a cornerstone of modern hospitality management.