The Middle East and North Africa’s booming e-commerce market presents a dazzling opportunity for small businesses, yet it simultaneously conceals a labyrinth of logistical complexities that can stifle growth before it even begins. In this fragmented landscape, a new player is emerging to provide a unified path forward. Egypt-based e-commerce logistics platform, Flextock, has successfully secured a significant $12.6 million in a Series A funding round, signaling a new chapter for merchant empowerment in the region.

A Major Boost for MENA’s E-commerce Backbone

The injection of capital, led by the prominent venture capital firm TLcom Capital, marks a pivotal moment for Flextock and the thousands of businesses it serves. The round saw robust participation from a consortium of investors, including Conjunction Capital, Capria Ventures, and Access Bridge Ventures, underscoring widespread confidence in the company’s model. This funding is more than just a financial milestone; it represents a powerful endorsement of Flextock’s vision to build the operational backbone for digital commerce.

For the small and medium-sized enterprises (SMEs) that form the lifeblood of the MENA economy, this investment translates into enhanced access to enterprise-grade logistics and financial tools. By leveling the playing field, Flextock empowers smaller merchants to compete effectively with larger, more established players, fostering a more inclusive and dynamic e-commerce ecosystem.

The Genesis of Flextock: From Inception to Pre-Seed

Founded in 2021 by Mohamed Mossaad and Enas Siam, Flextock was born from a direct understanding of the critical bottlenecks hindering e-commerce growth. The founders identified a pressing need for a cohesive solution that could manage the disparate elements of online retail, from warehousing to last-mile delivery. The company established its operational footprint in the key markets of Egypt and Saudi Arabia, positioning itself at the heart of the region’s digital transformation.

This recent Series A success was built upon a solid foundation. The company’s initial momentum was fueled by a $3.25 million pre-seed round, which enabled it to validate its business model and develop the core technology. That early support provided the necessary runway for Flextock to demonstrate its value and attract the substantial investment required for its next phase of expansion.

Flextock’s Integrated Platform: A Closer Look

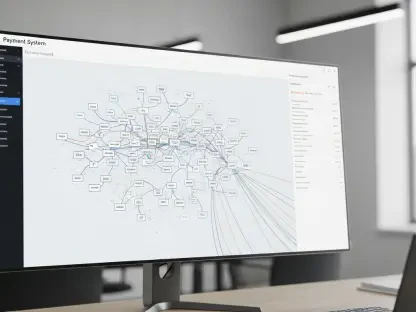

Flextock’s core innovation lies in its comprehensive product suite, which functions as a unified operating system for merchants. This integrated approach is designed to eliminate the need for businesses to cobble together services from multiple vendors, thereby reducing complexity and improving efficiency.

End-to-End Fulfillment and Logistics

At the heart of the platform are its end-to-end fulfillment services. Flextock manages everything from inventory storage and management to picking, packing, and shipping. Moreover, its last-mile delivery aggregation system optimizes the final step of the customer journey, ensuring timely and cost-effective deliveries by connecting merchants with a network of reliable couriers.

Enabling Cross-Border Commerce

The platform is engineered to break down geographical barriers, enabling merchants to expand their reach beyond domestic markets. Flextock facilitates cross-border trade by simplifying complex customs and shipping procedures, while also providing access to new sales channels across the region. This capability is crucial for ambitious SMEs looking to tap into the broader MENA consumer base.

Data-Driven Merchant Financing

Perhaps one of its most innovative features is the provision of embedded, data-driven financing. By analyzing a merchant’s sales and inventory data, Flextock can offer tailored working capital solutions. This addresses a major pain point for SMEs, which often struggle to secure traditional financing, allowing them to invest in inventory and marketing to fuel their growth.

The Competitive Edge: A Unified System for Merchants

Flextock’s primary value proposition is its ability to reduce the fragmentation that plagues e-commerce operations. Merchants are often forced to navigate a complex web of separate providers for warehousing, shipping, payment processing, and financing. Flextock consolidates these functions into a single, seamless platform, giving business owners a holistic view of their operations.

This unified system not only simplifies management but also delivers significant cost savings. By leveraging Flextock’s shared infrastructure, merchants can avoid the heavy fixed costs associated with building their own logistics networks. This allows them to scale their operations efficiently, paying only for the services they use and preserving capital for other critical business needs.

Inside the $12.6M Series The Investors and Strategic Vision

The leadership of TLcom Capital in this funding round, alongside the participation of other key investors like Foundation Ventures and JIMCO, highlights a strategic alignment with Flextock’s long-term vision. These partners bring not only capital but also deep industry expertise and a network that will be instrumental in guiding the company’s expansion.

Flextock has outlined a clear roadmap for the new capital. A significant portion will be dedicated to expanding its operational infrastructure, including warehousing capacity and technology enhancements. The funds will also be used to accelerate merchant acquisition in its core markets of Egypt and Saudi Arabia, further solidifying its position as a regional leader.

Reflection and Broader Impacts

The company’s rapid ascent and successful funding underscore a clear market need for its integrated solutions, but the path ahead involves navigating both immense opportunities and significant challenges.

Reflection

Flextock’s strength lies in its asset-light, technology-first model, which empowers SMEs without requiring them to make prohibitive upfront investments. However, the challenge of rapid scaling across diverse regulatory and cultural landscapes in the MENA region cannot be underestimated. Maintaining high service quality while managing exponential growth will be critical, especially as competition in the e-logistics space intensifies.

Broader Impact

Beyond its own corporate growth, Flextock is playing a crucial role in building the foundational infrastructure for the region’s digital economy. By providing reliable and scalable logistics, it enables a new generation of entrepreneurs to launch and grow their businesses online. This, in turn, fosters economic development, creates jobs, and sets a new standard for what e-commerce merchants should expect from their logistics partners.

Paving the Way for a Streamlined E-commerce Future

The successful $12.6 million fundraising round marked a resounding validation of Flextock’s mission to unify the disparate elements of e-commerce for merchants across the Middle East and North Africa. The company’s integrated platform, combining logistics with financial services, had already begun to redefine operational efficiency for countless small and medium-sized enterprises.

With this substantial capital injection, Flextock was well-positioned to execute its strategic expansion plans, deepening its footprint in key markets and enhancing its technological capabilities. The company’s journey from a nascent startup to a pivotal player in the regional ecosystem demonstrated the profound impact of addressing fundamental market fragmentation, paving the way for a more streamlined and accessible digital future for all businesses.