APPlife Digital Solutions recently unveiled a financial quarter that presents a classic paradox for investors, showcasing an explosive 93% surge in revenue alongside a troubling expansion of its net loss, raising fundamental questions about the sustainability of its growth-at-all-costs strategy. The e-commerce incubator’s report for the second quarter of fiscal year 2026, which concluded on December 31, 2025, paints a vivid picture of a company in a state of rapid, deliberate transformation. This period of intense activity was marked by heavy investment in technology and product expansion, particularly within the aftermarket automotive sector. While the top-line figures suggest a resounding success, the bottom-line results introduce a note of caution, highlighting the significant capital required to fuel such aggressive market penetration. The company’s performance reflects a high-stakes bet on long-term market leadership, predicated on the idea that achieving scale now will pave the way for future profitability, a common but perilous path for technology-driven enterprises.

An Aggressive Push into Automotive E-commerce

Rebuilding the Digital Foundation

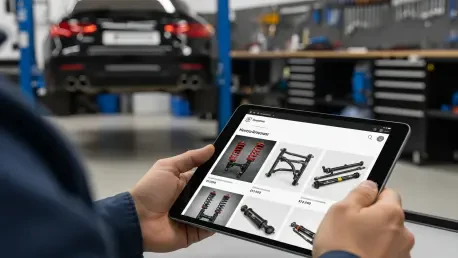

The cornerstone of APPlife’s recent strategic pivot is a deep and comprehensive technical overhaul of its primary e-commerce asset, LiftKits4Less.com, a move catalyzed by the acquisition of Sugar Auto Parts. This was not a minor update but a fundamental rebuild of the platform’s architecture, designed to create a more scalable and efficient operational backbone for its burgeoning automotive parts business. Key features introduced during this overhaul included real-time inventory synchronization across its supplier network and a sophisticated automated fulfillment system. These enhancements are critical in the competitive e-commerce landscape, as they directly address customer expectations for accurate stock information and prompt order processing. The immediate impact was a dramatic expansion of the company’s product catalog. APPlife successfully increased its real-time access to over 175,000 unique SKUs, representing a 40% jump from earlier in 2025. Looking forward, the company has set an even more ambitious goal: to further expand its accessible inventory to a range of 350,000 to 450,000 SKUs by the end of 2026, a target that underscores its intent to become a dominant player in the online automotive aftermarket space.

Translating Tech into Record Revenue

The substantial investments in platform technology yielded immediate and impressive returns on the top line. For the quarter, APPlife reported record revenue of $894,309, a staggering 93% increase compared to the $464,172 generated in the preceding quarter. This remarkable growth was not coincidental but a direct result of the enhanced capabilities of its revamped e-commerce engine. The combination of a vastly larger product selection and a more efficient user experience, supported by more effective digital media campaigns, created a powerful synergy that drove a significant increase in website traffic. More importantly, the platform improvements led to higher conversion rates, turning more visitors into paying customers and boosting overall sales volume. The positive financial impact was also visible in the company’s profitability on a per-sale basis. Gross profit soared to $226,854 from the prior quarter’s $105,024. Simultaneously, the gross margin—a key indicator of sales efficiency—improved from 23% to 25%, demonstrating that the company was not only selling more but was also retaining a healthier portion of each dollar in revenue before accounting for operational overhead.

The High Cost of Rapid Expansion

The Anatomy of a Widening Deficit

While revenue and gross profit painted a rosy picture, the company’s bottom line told a different story, one defined by the heavy costs associated with its aggressive expansion. Operating expenses for the quarter surged to $774,701, a substantial increase from the $467,966 recorded in the previous quarter. This escalation in spending was multifaceted, driven by a series of necessary investments to support the company’s growth trajectory. A significant portion of the increase was attributed to higher labor costs, likely stemming from the need to hire talent to manage the technical rebuild and expanded operations. Professional fees and expenses related to regulatory compliance filings also contributed to the rise, reflecting the administrative burdens of a growing public company. Furthermore, a considerable investment was made in advertising to promote the newly acquired Sugar Auto Parts brand and drive traffic to its developing marketplace. The cumulative effect of these expenditures completely overshadowed the gains in gross profit, leading to a net loss of $998,866. This figure stands in stark contrast to the net income of $96,322 reported in the prior quarter, illustrating the significant financial trade-off the company made to achieve its record-setting revenue growth.

A Calculated Bet on Future Value

Despite the significant net loss, APPlife’s leadership framed the quarterly results as a validation of its strategic direction. CEO Michael Hill emphasized that the performance confirmed the effectiveness of the company’s focus on platform optimization and demonstrated the inherent scalability of its e-commerce model. The forward-looking strategy articulated by the company involves a delicate balancing act: continuing to pursue organic growth while maintaining a disciplined approach to capital allocation to manage cash burn. The expansion efforts are set to continue across its portfolio, which includes both the established LiftKits4Less.com and the newer, still-developing SugarAutoParts.com multi-seller marketplace. Beyond its internal growth initiatives, the company signaled its intention to remain active on the acquisition front. Management is actively evaluating selective acquisition opportunities that align with its core focus on the automotive e-commerce sector. This dual approach of organic and inorganic growth is designed to consolidate its market position and, in the view of the company, ultimately drive long-term shareholder value, even if it requires absorbing substantial losses in the near term. The quarter was a clear statement that the company chose to prioritize market share and infrastructure over immediate profitability.